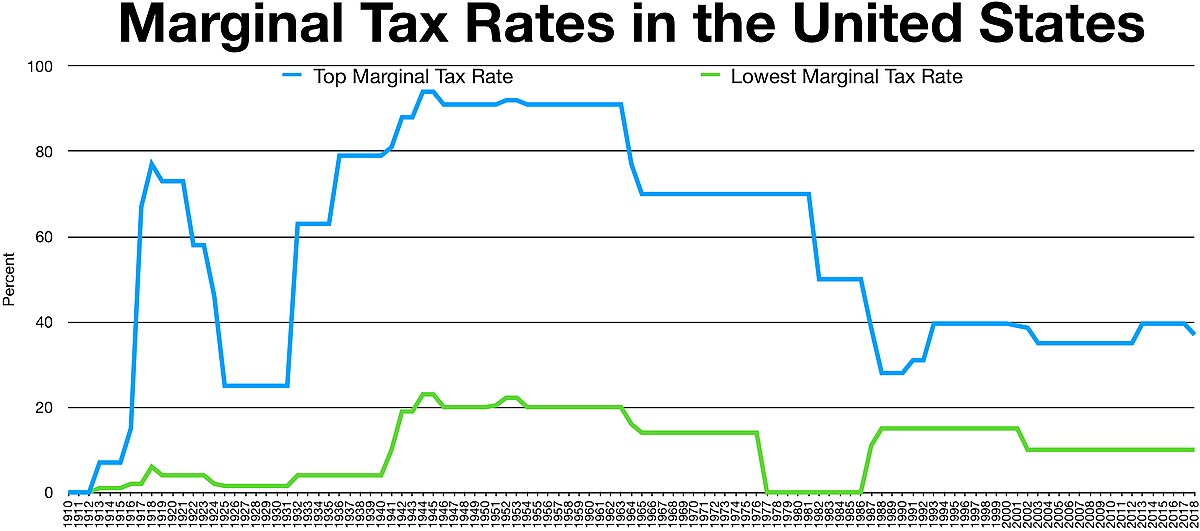

History of top marginal tax rates in the US. Source: US Joint Committee... | Download Scientific Diagram

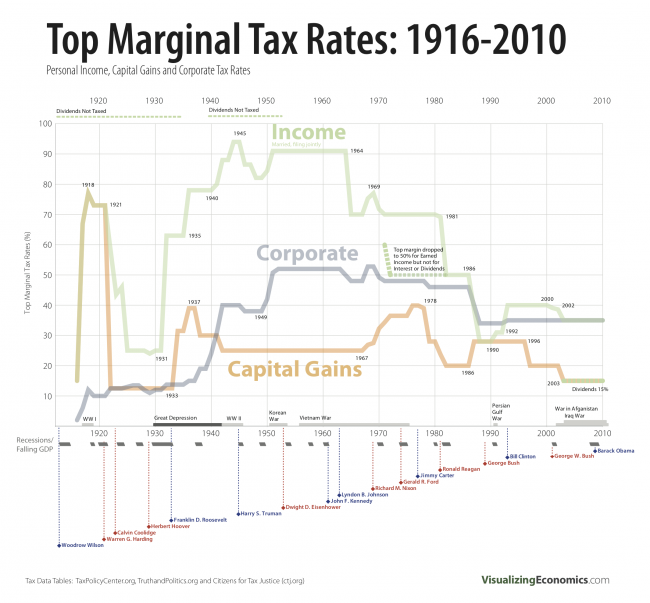

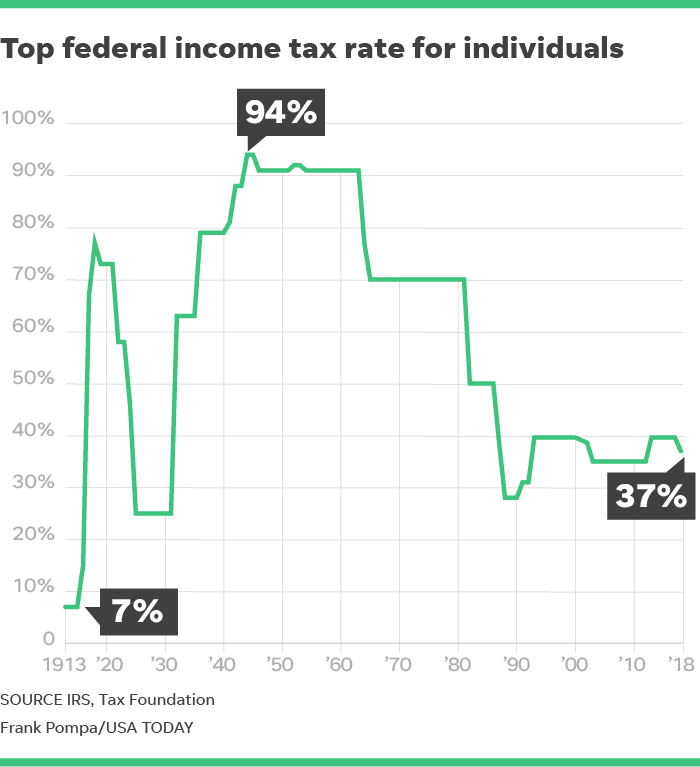

تويتر \ FiveThirtyEight على تويتر: "The top marginal tax rate was as high as 94% in the 1940s, and throughout the 1970s, Americans in the top income bracket (which in 1970 was

![Taxing The Rich: The Evolution Of America's Marginal Income Tax Rate [Infographic] Taxing The Rich: The Evolution Of America's Marginal Income Tax Rate [Infographic]](https://specials-images.forbesimg.com/imageserve/60868250060f8ad8dd0c97eb/960x0.jpg?fit=scale)

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)